In normal years, Spring is the busiest time of the year in real estate in Scotch Plains. Due to several different factors that trend has changed a bit recently. Since the middle of March of 2020, when the lockdown started and many sellers took their homes off the market, the inventory in Scotch Plains has remained low.

In normal years, Spring is the busiest time of the year in real estate in Scotch Plains. Due to several different factors that trend has changed a bit recently. Since the middle of March of 2020, when the lockdown started and many sellers took their homes off the market, the inventory in Scotch Plains has remained low.

Why? Well, there are several reasons: many people were nervous about strangers coming into their homes and risking possible infection, then there were layoffs, we saw lots of companies shutting down, and there were many other factors that figured into the equation. From mid-March until May of 2020 the number of homes on the market, as well as those going under contract (meaning that they’ve accepted an offer and agreed to the terms) decreased at historic rates. Before the pandemic, inventory was already low and we were in a growing seller’s market, meaning that there are more buyers than sellers. This gives sellers the upper hand and causes prices to rise, due to the higher demand. Combine this with historic lows in inventory and this is the market that we’re now in.

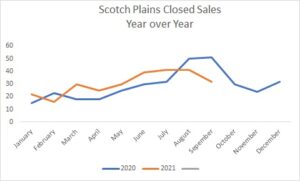

But, in the Spring of 2020, as the weather began warming up, the great urban exodus began. All of a sudden, lots of people, especially those living in New York City metropolitan area, were looking to move to towns like Scotch Plains where things are more spread out than in the cities. From mid-May through the end of 2020, the market in Scotch Plains went crazy. With the exception of the number of homes coming on the market, leaving the inventory at very low levels which added to the strong seller’s market. When new listings hit the market, there is a frenzy of showings that usually results in multiple offers coming in on the home. This is truly a great situation for sellers, but not so great for the buyers. This scenario leads to bidding wars and rising prices. Some buyers are getting fatigued, after losing out on home after home, but working with an agent that understands the market can help buyers make educated decisions that can help them be the winning bid on their dream home.

All of this is great news if you already own a home or are thinking about selling. It’s likely that you’ll be able to sell your home for more than you thought it was worth and it should sell quickly. If you’re not going to sell, refinancing might be a smart move especially if you want to get some equity out for improvements or maintenance.

All of this is great news if you already own a home or are thinking about selling. It’s likely that you’ll be able to sell your home for more than you thought it was worth and it should sell quickly. If you’re not going to sell, refinancing might be a smart move especially if you want to get some equity out for improvements or maintenance.

We’re now in a situation where there are fewer homes yet there are more buyers coming on the market, statistics show that the largest percentage of buyers in New Jersey are millennials, which is a new factor in the equation. Combine low inventory, a new generation of buyers and people leaving the cities to come to towns like Scotch Plains and you have the formula for a very strong seller’s market that should continue for some time.

But how long with this last?

In 2020 the median sale price in Scotch Plains rose more than 12%! So far in 2021, prices have risen another 15%! During the last 2 years, the median home price in Scotch Plains has risen by over 27%!!! Several leading forecasters are predicting that inventory will remain low and prices will continue to rise through the end of next year. They are also forecasting that in 2022 prices will rise by another 5 percent and possibly even more! This is simply amazing news if you’ve been in your home and are considering selling to downsize.

During the last 2 years, the median home price in Scotch Plains has risen by over 27%!!! Several leading forecasters are predicting that inventory will remain low and prices will continue to rise through the end of next year. They are also forecasting that in 2022 prices will rise by another 5 percent and possibly even more! This is simply amazing news if you’ve been in your home and are considering selling to downsize.

What will happen after 2022?

The leading industry forecasters are predicting that there will be a correction in the market in 2023. When the correction happens, prices will likely drop, anywhere from 1% to 5% for a year or two. After the market correction, we should return to a normal market where prices rise 2-3% per year. Again, the experts are predicting a short correction, not like what we went through in the late 2000’s into the teens.

Are you thinking about buying a house in Scotch Plains?

Buyers, that I meet, most often ask me: “Should I wait for prices to come down?” My answer is a resounding “NO! Don’t wait! Buy now!” Interest rates are still at very low levels, buyers have more purchasing power and my advice would be to buy now. Think about it this way, for every 1% rise in interest rates, buyers lose 9% of buying power. Let’s say that you are qualified to buy a $400,000 house with a 5% down payment and the interest rate on your mortgage is 3%. What happens to your buying power if the interest rate rises to 4%? Now, you’ll only qualify to buy a house for $364,000. That’s a big difference, yet your monthly payment will be nearly the same for both. The chart on the right shows buying power with today’s rates, which are around 3% and how that buying power would change at different price points.

Buyers, that I meet, most often ask me: “Should I wait for prices to come down?” My answer is a resounding “NO! Don’t wait! Buy now!” Interest rates are still at very low levels, buyers have more purchasing power and my advice would be to buy now. Think about it this way, for every 1% rise in interest rates, buyers lose 9% of buying power. Let’s say that you are qualified to buy a $400,000 house with a 5% down payment and the interest rate on your mortgage is 3%. What happens to your buying power if the interest rate rises to 4%? Now, you’ll only qualify to buy a house for $364,000. That’s a big difference, yet your monthly payment will be nearly the same for both. The chart on the right shows buying power with today’s rates, which are around 3% and how that buying power would change at different price points.

If you’re renting or don’t own a home you should look into buying now, it makes financial sense. But what if the prices fall as predicted? Either way, the interest rates are likely to rise. You can get more bang for your buck now than you can by waiting.

Are you considering buying? Here’s our free Buyer’s Guide.

Is selling your home in the near future?

If so, don’t wait, do it! The market that we’re in right now is an amazing time to sell your home. Most of our recent listings have had one day of showings, usually at an Open House, and are getting multiple offers and selling over list price! Very simply put, in this market, if homes are priced properly, they will sell quickly and in most cases above list price. Therd are more buyers than sellers, and the buyers want to buy! If you’re selling, the market is working in your favor, if you’re ready to make a move, you’re likely to get more equity out of your home than you thought you could. Selling now will likely enable you to move into a nicer home, have more cash on hand or both.

Are you thinking of selling your home? Take a look at our free Seller’s Guide.

Regardless of your situation, whether you choose to sell, buy, or just wait, know that I’m here for all your real estate needs. Feel free to contact me with any questions you have. If you’d like monthly or quarterly updates on Scotch Plains or any town in the area, just let me know.

All opinions, information and data provided are deemed reliable but are subject to errors and omissions. Not intended to solicit other Brokers’ clients. We cooperate with them fully.