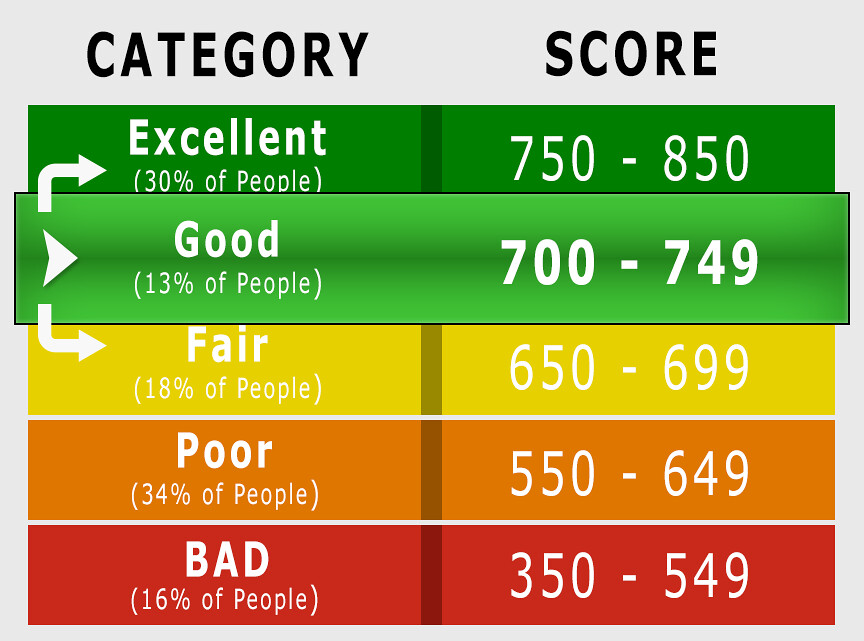

When you’re applying for a mortgage, your credit score can have a big impact not only on the mortgage rate you get but also on how much you can borrow. One of the critical first steps in buying a home is ensuring that your credit score is as high as possible to allow you the most flexibility, but many people aren’t aware of how credit scores are calculated.

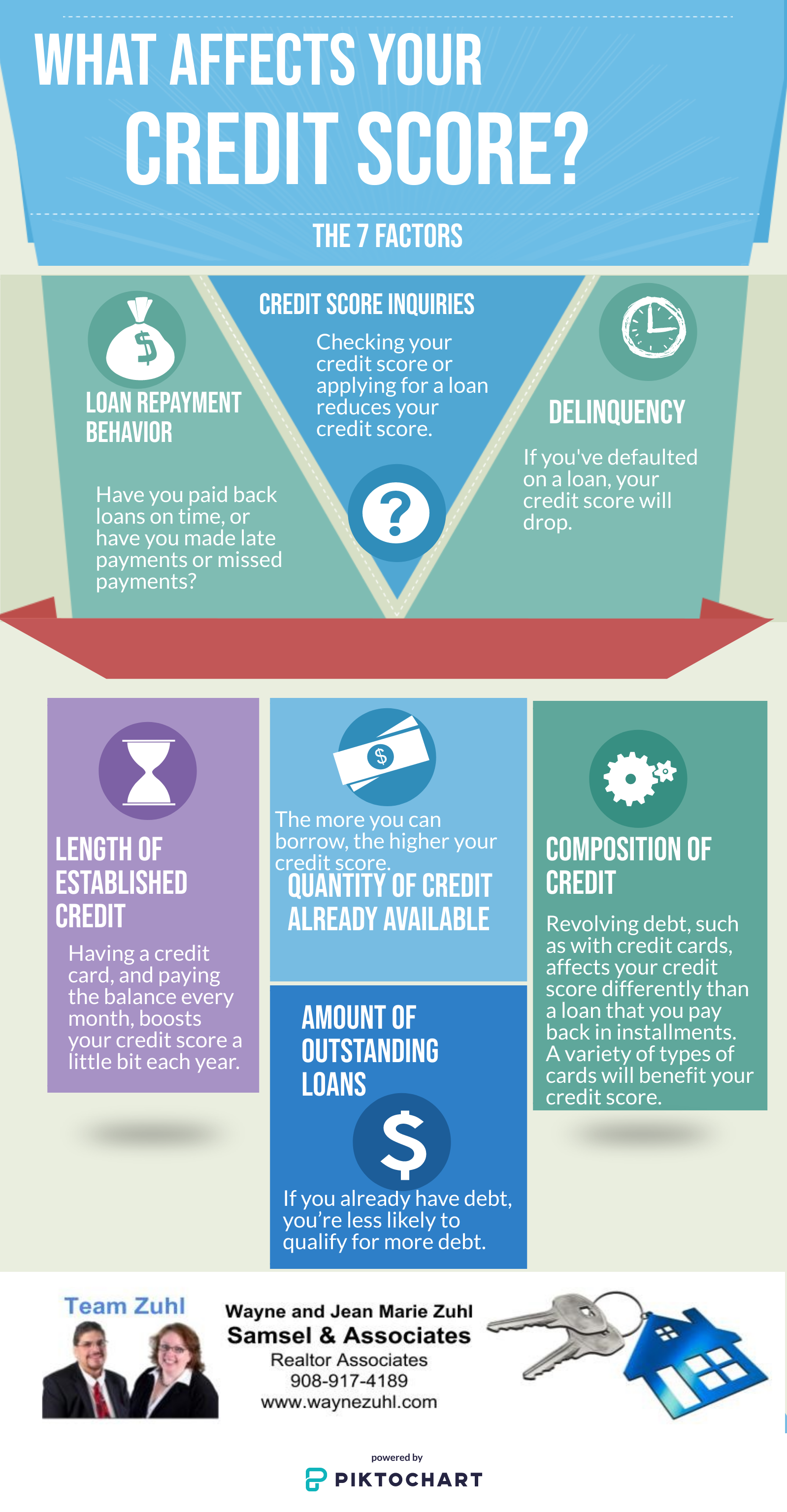

Your credit score is a numeric value that incorporates all of your credit and payment history into a mathematical equation and calculates the probability of repayment of any future loan. The seven factors that are included in this calculation are:

- loan repayment behavior

- credit score inquiries

- delinquency of loans

- length of established credit

- composition of credit

- quantity of credit already available

- amount of outstanding loans